- Study finds global fashion industry’s response to environmental urgency lacking

- Study states customers don’t know which brands are practicing sustainability and brands don’t educate customers

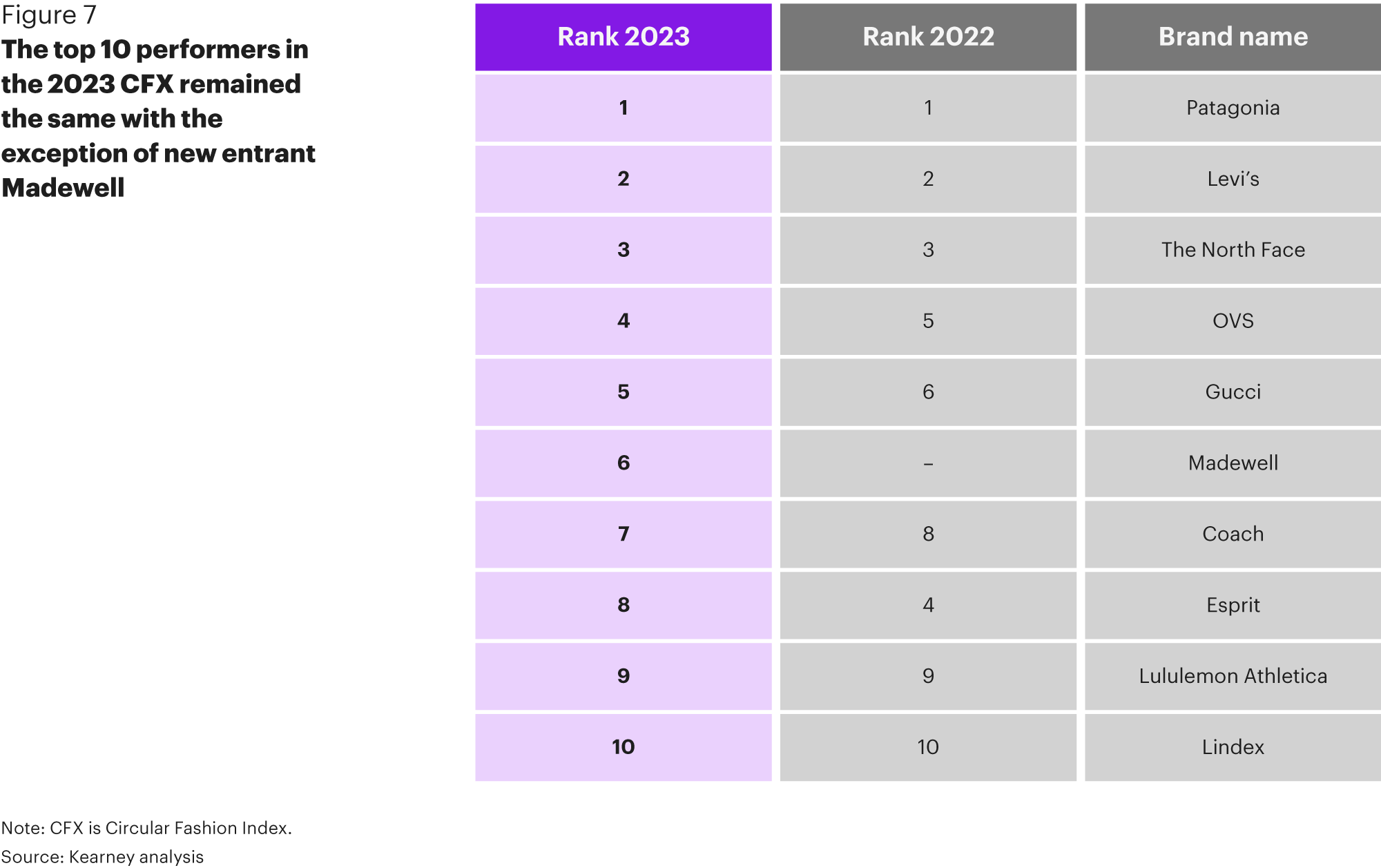

- The top 3 ranking companies have remained unchanged in all 3 editions of the CFX

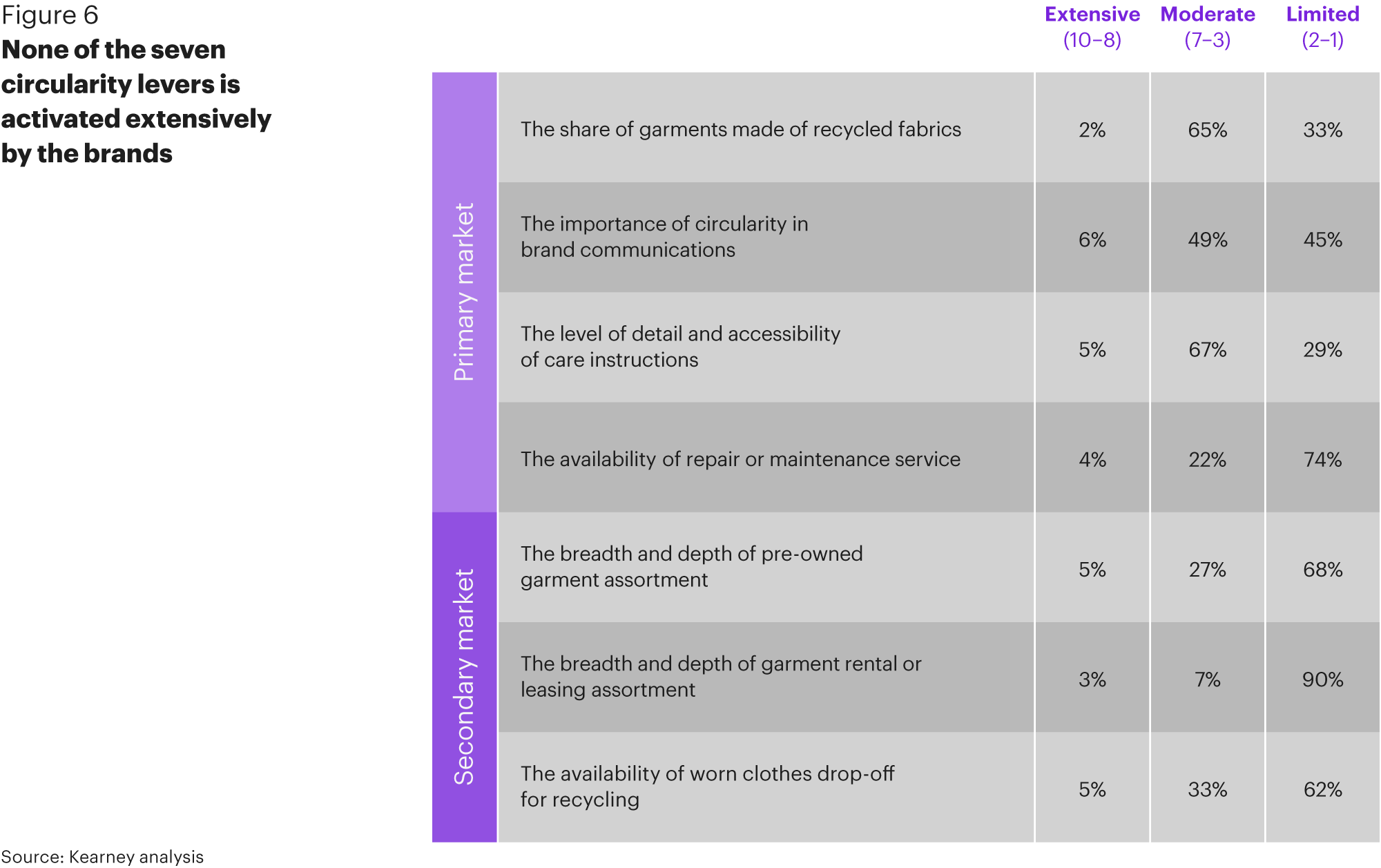

- 7 circularity metrics are measured; companies have not extensively activated any

- 5 of the top 10 ranked brands are US-based; France has the top CFX score

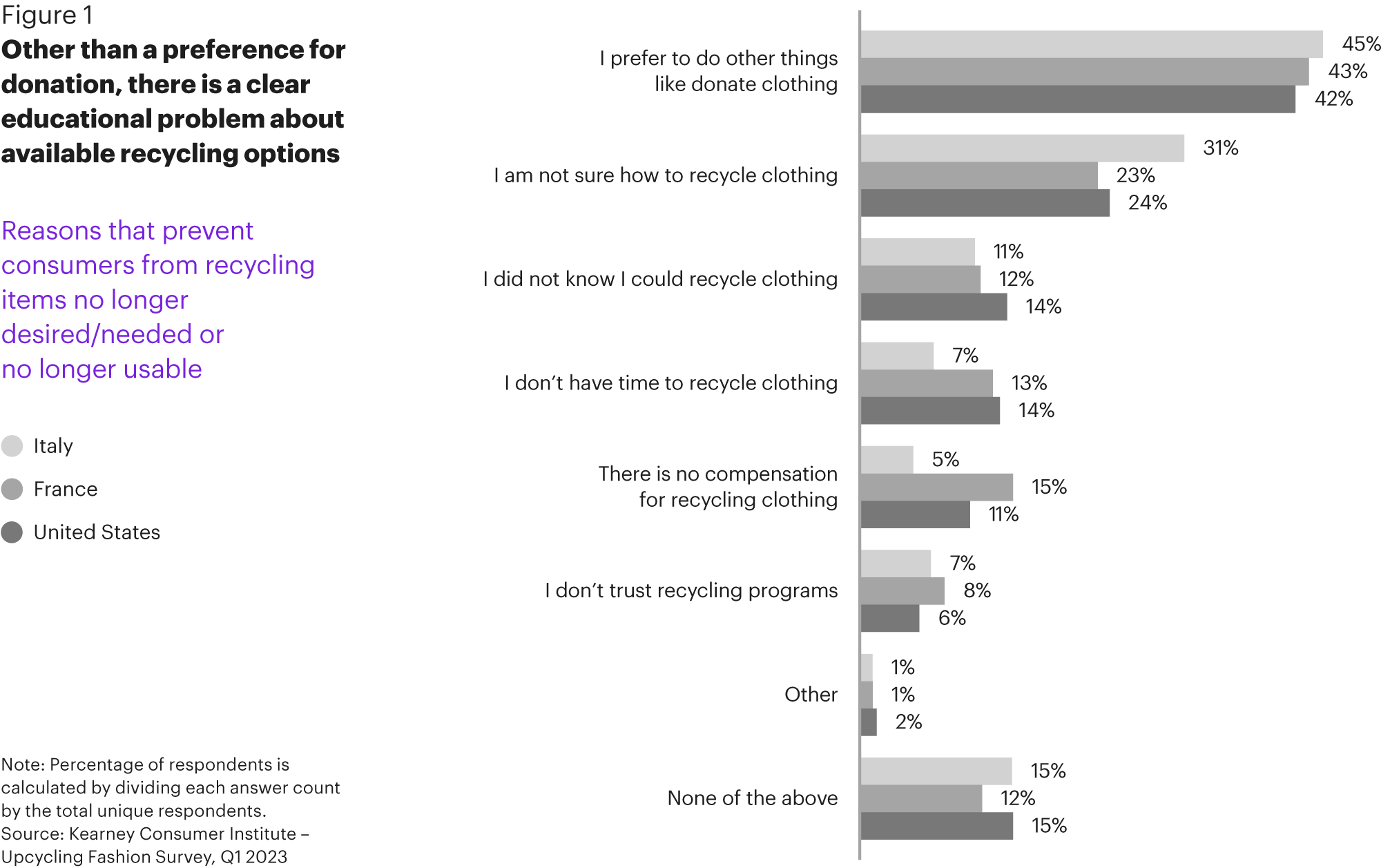

- On the consumer side, 30 to 40% of fashion customers remain unaware of recycling/upcycling options

Global management consulting firm Kearney released the 2023 Circular Fashion Index (CFX), its third study measuring the global fashion industry’s progress toward circularity and sustainability. Based on proprietary analysis, the CFX acts as an objective tool helping companies understand where they rank in their sustainability practices and which circularity levers remain to be pulled. Notwithstanding the Fashion Pact launched at the G7 Summit in France in 2019, the industry remains one of the highest global polluters—hence the value of measuring progress. Kearney’s 2023 CFX finds that the needle has barely moved since last year’s report, with the 200 global brands analyzed barely reaching an average of 2.97 on a circularity scale of 10.

A recent Kearney Consumer Institute (KCI) survey of consumers in Italy, France, and the United States shows a lack of education on sustainability when it comes to buying and disposing of fashion products. Almost half of respondents could not say whether virgin materials are better or worse than recycled/upcycled ones, and 30 to 40 percent either weren’t aware they could return clothes for recycling/upcycling or didn’t know how to do it. No surprise then that most consumers would rather donate clothes or share them with friends and family. In the best scenario those clothes are used again, but more often they end up in a closet until it’s time for the next donation. Even the secondhand resale market is not developed as much as it could be.

Similar to post-consumer products, pre-consumer products (unsold stock) and textiles (scraps) also aren’t making their way back into the circular supply chain to the extent they should—again no surprise given that there are numerous barriers, in terms of infrastructure and technology, to overcome.

Underdeveloped Infrastructure

On the infrastructure side, the clothing drop-off and collection infrastructure is underdeveloped. Even sorting is complex and expensive because fashion products are not designed to be disassembled into sub-components for reuse.

Technology in Infancy

On the technology side, mechanical and chemical recycling are still in their infancy, and both are expensive. Mechanical recycling is more developed, while chemical recycling is just starting to gain traction (please read our interview with Renewcell in the appendix). Other value chain partners such as equipment manufacturers are trying to adapt their machines toward re-/upcycled materials.

What Brands Can Do Better

All that said, there should be no excuse for brands doing as little as Kearney’s 2023 CFX shows. For example, they could work more on consumer education, encouraging shoppers to shop more responsibly and to return more unused clothes, say by incentivizing in-store drop-off. Brands could also use modern technologies to better forecast their sales, increase sell-through, and reduce unsold stock, which typically runs as high as 30 percent of production volume. This would allow them to enjoy the same, or even better, sales and profits while producing and polluting less. Finally, they should design their products for sustainability—be it recycling or upcycling.

The latter is a valid option for post-consumer products, unsold stock, and deadstock fabrics and can substantially reduce the carbon footprint of fashion items. It has been estimated that opting for an upcycled pair of jeans can save up to 83 percent CO2 Kg when compared with a traditional pair, thanks to avoiding of main manufacturing phases, the nearshoring of the remaining ones, and reducing emissions from transportation.

Survey Methodology

For the third edition of its CFX study, Kearney expanded the scope of the panel to include 200 global brands from 20 countries across six categories: sports and outdoor, underwear and lingerie, luxury, premium/affordable luxury, mass market, and fast fashion.

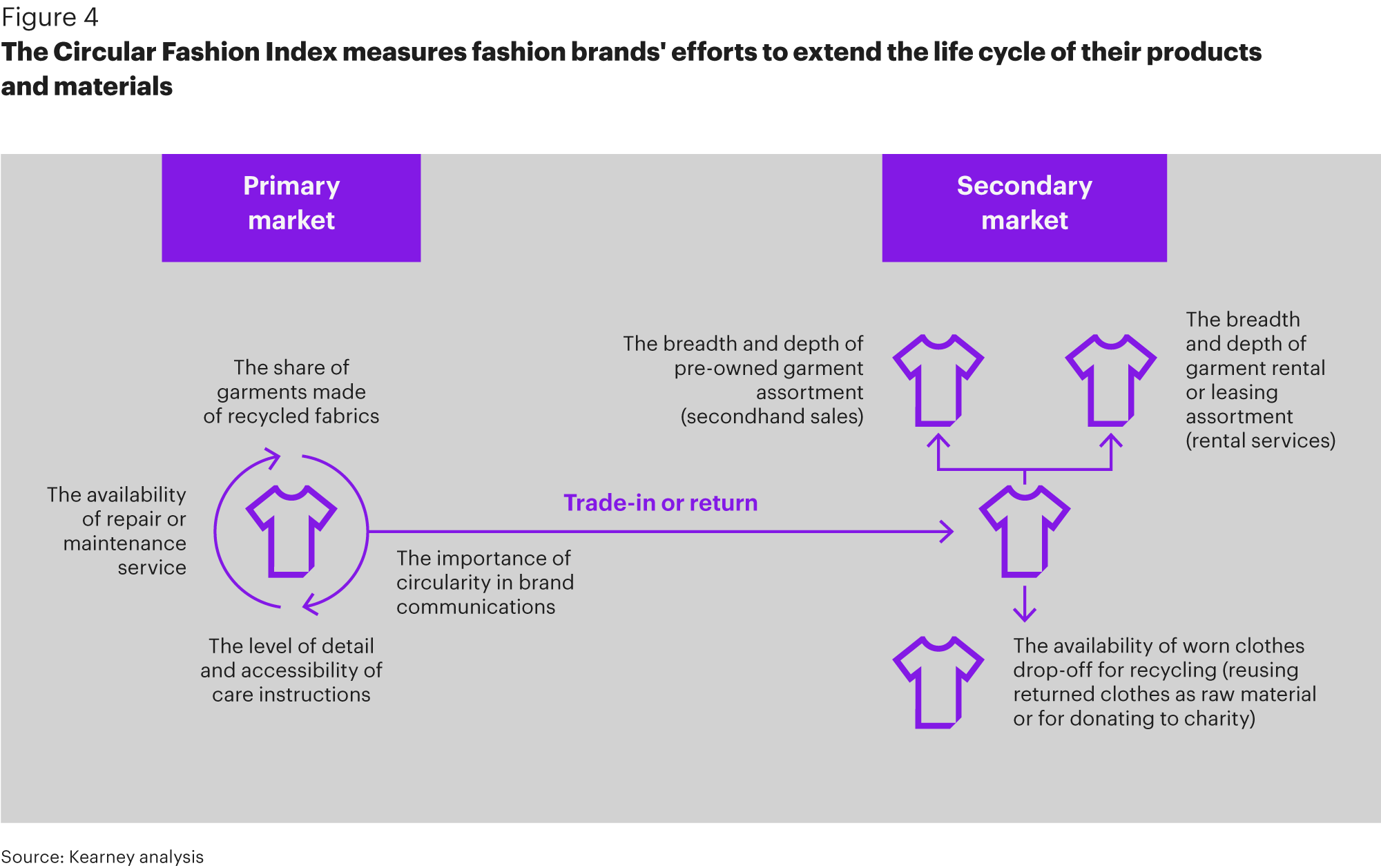

A company’s CFX score is based on seven dimensions affecting the circularity impact of the brand. These dimensions include two perspectives: the primary market (affecting new product sales to consumers) and the secondary market (such as the secondhand market or recycling). We’ve weighted the scores for each dimension, giving the most weight to share of recycled fabrics followed by availability of repair/maintenance, secondhand sales, rental services, and reuse of returned clothes as raw material or for donations.

The Circular Fashion Index 2023 results

This year’s average CFX score, across the 200 fashion brands analyzed, is just 2.97 out of 10, a result similar to our 2022 results, confirming that the industry still has much to do (see figure 5). That said, there was a slight improvement in the scores of the brands analyzed in last year’s study.

Consistent with our 2022 results, none of the seven circularity levers is activated extensively by the brands, with all of them operating in the 2 to 6 percent range.

Primary market levers are pulled more often than secondary market ones (except for the availability of repair or maintenance services). Brands tend to have detailed care instructions and are using increasing shares of recycled materials. But little is being done on communicating the importance of circularity to consumers. This consumer education gap has been confirmed by recent studies by the Kearney Consumer Institute.

On the secondary market, there is little effort being put into developing rental services, not surprising given the higher complexity of implementation. It is concerning to see that worn clothes drop-off for recycling is not being more broadly offered to consumers as this would play a crucial role in extending the life of garments and making materials available for recycling and upcycling. Pre-owned assortments are also still limited, potentially due to the role played by specialized players in this space.

TOP PERFORMERS

Familiar faces populate the 2023 CFX winner’s podium. This year’s top firms were Patagonia, Levi’s, and The North Face – brands that have led each of Kearney’s earlier two studies – scoring 8.65, 8.30, and 7.90 respectively. While Patagonia and Levi’s were able to improve their (already high) score versus 2022, The North Face’s score decreased slightly.

Patagonia improved its score primarily by increasing promotion and communication of circularity. The company began evaluating its products on a 10-point scale based on repairability, durability, and functionality to determine areas of redesign that will have an environmental impact.

Like Patagonia, Levi’s score improvement was the result of increased promotion and communication of circularity. In addition, the company builds consumer awareness by promoting its sustainability campaigns and projects. Levi’s has also created a separate shopping page for recycled denim products. Finally, this year Levi’s started disclosing its supplier map to show its carbon footprint.

Overall, the top 10 performers remained unchanged versus 2022, except for Madewell which made a successful debut in the CFX, ranking sixth.

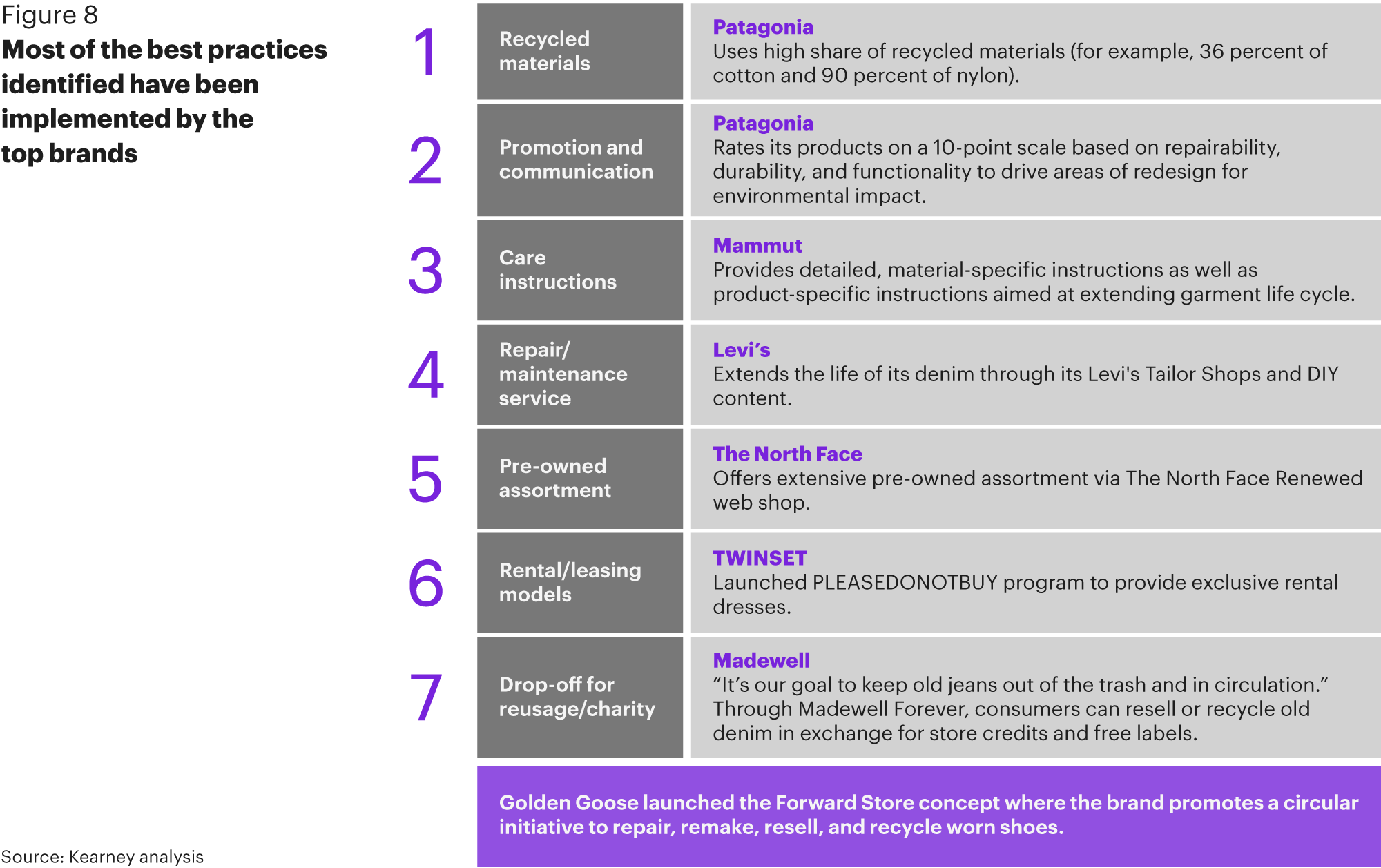

Most of the best practices identified across the seven dimensions of analysis have been implemented by the brands in the top 10, as well as some others which lead in the respective category.

STRONGEST IMPROVEMENTS

That’s not to say other brands are sitting still. The ones showing the strongest improvement over last year are sports/outdoor brand Athleta, premium brand Timberland, and luxury brand Jimmy Choo.

Athleta

Showing the highest improvement in the usability of raw material, Athleta introduced a program called “thredUP x Athleta,” where shoppers earn shopping credits by returning items from eligible brands. Items from other brands will be reused or responsibly recycled.

The brand also demonstrated high improvement in secondhand use. In September 2022, Athleta launched its first-ever resale platform “Always Athleta,” a 360-resale program enabled by thredUP’s resale-as-a-service (RaaS). Customers can shop a wide range of gently used Athleta products up to 90 percent off estimated retail price.

Timberland

The brand enjoyed the highest improvement in secondhand use (tied with Jimmy Choo). During 2022 Timberland reinforced its partnership with ReCircled to globally extend the take-back service (both in store and by shipment) of used Timberland products with the aim of repairing and reselling them on its “re-commerce” ad-hoc platform. It also showed high improvement in end-of-life solutions and usability of raw materials. As part of the take-back service, Timberland offers both drop off in selected stores and a shipment service for worn items. Where products cannot be repaired, their parts are converted into raw materials to create new products instead of sending them to landfills.

Jimmy Choo

Jimmy Choo showed the highest improvement in secondhand use (tied with Timberland). In October 2022, the company launched a partnership with The RealReal to promote the secondhand market and to reinforce the brand commitment toward circularity. Customers reselling their products through the platform are offered an exclusive experience at Jimmy Choo boutiques.

Jimmy Choo also saw moderate improvement on share of recycled raw materials. Starting almost from scratch, in 2022 the brand increased the share of product portfolio made from recycled (for example, Econyl, recycled leather) or responsibly sourced (for example, GOTS cotton, FSC viscose) materials.

HIGHEST NEW JOINEES

As we mentioned earlier, this year’s panel was significantly expanded to better represent different geographies and categories. Among the newly added brands, the ones which scored the highest are mass market brand Madewell (overall rank #6), sports/outdoor brand Mammut, premium/affordable luxury brand GANNI, and luxury footwear brand Golden Goose.

Madewell

Madewell scores well across most dimensions, especially in secondhand use due to their Madewell Forever program, as well as their take-back programs to keep old clothes from ending in landfills.

Mammut

The Swiss outdoor brand scores well in high share of recycled materials, communication, as well as care instructions and repair services. Also, the brand engaged The Renewal Workshop for take-back pilot projects in Germany and Austria.

GANNI

The Danish fashion brand piloted repair and customization pop-ups in selected stores in Denmark, the United Kingdom, and the United States.

GANNI also partnered with Reflaunt, a resale-as-a-service provider as well as with UK rental platforms HURR and Rotaro to reignite rental efforts outside of Denmark.

Golden Goose

The Italian luxury footwear brand launched a new store concept called Forward Store, where the brand promotes circular initiatives of repair (repair services in store and soon also online), remake, resell (collection of secondhand Golden Goose shoes), and recycle (drop-off services for old shoes).

CFX Scores by Country

More than 80 percent of the 200 brands analyzed in CFX 2023 are from the United States, France, Italy, India, Germany, and the United Kingdom. Except for Indian brands, which score significantly lower than the rest of the panel, the results from other countries are fairly aligned, with average scores ranging between 2.6 and 3.4, confirming that there is a lot to do everywhere across the globe. French brands have the highest average score followed by American and German brands.